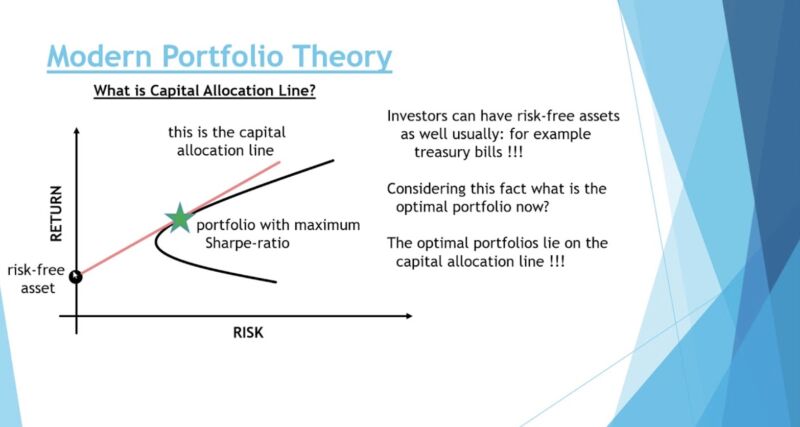

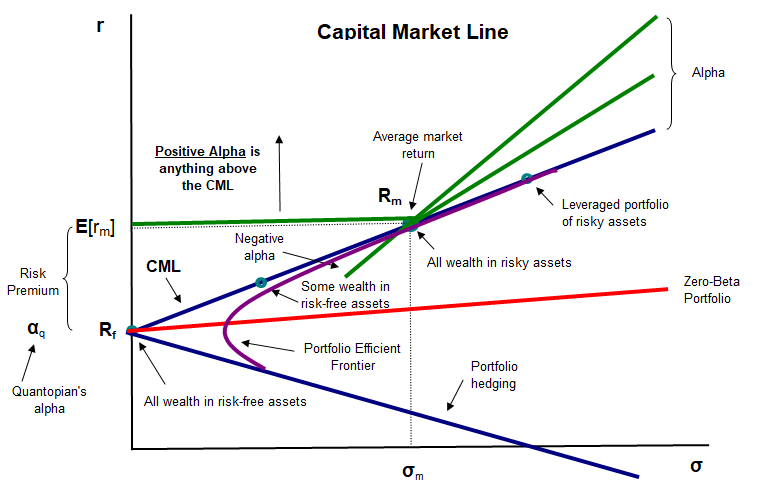

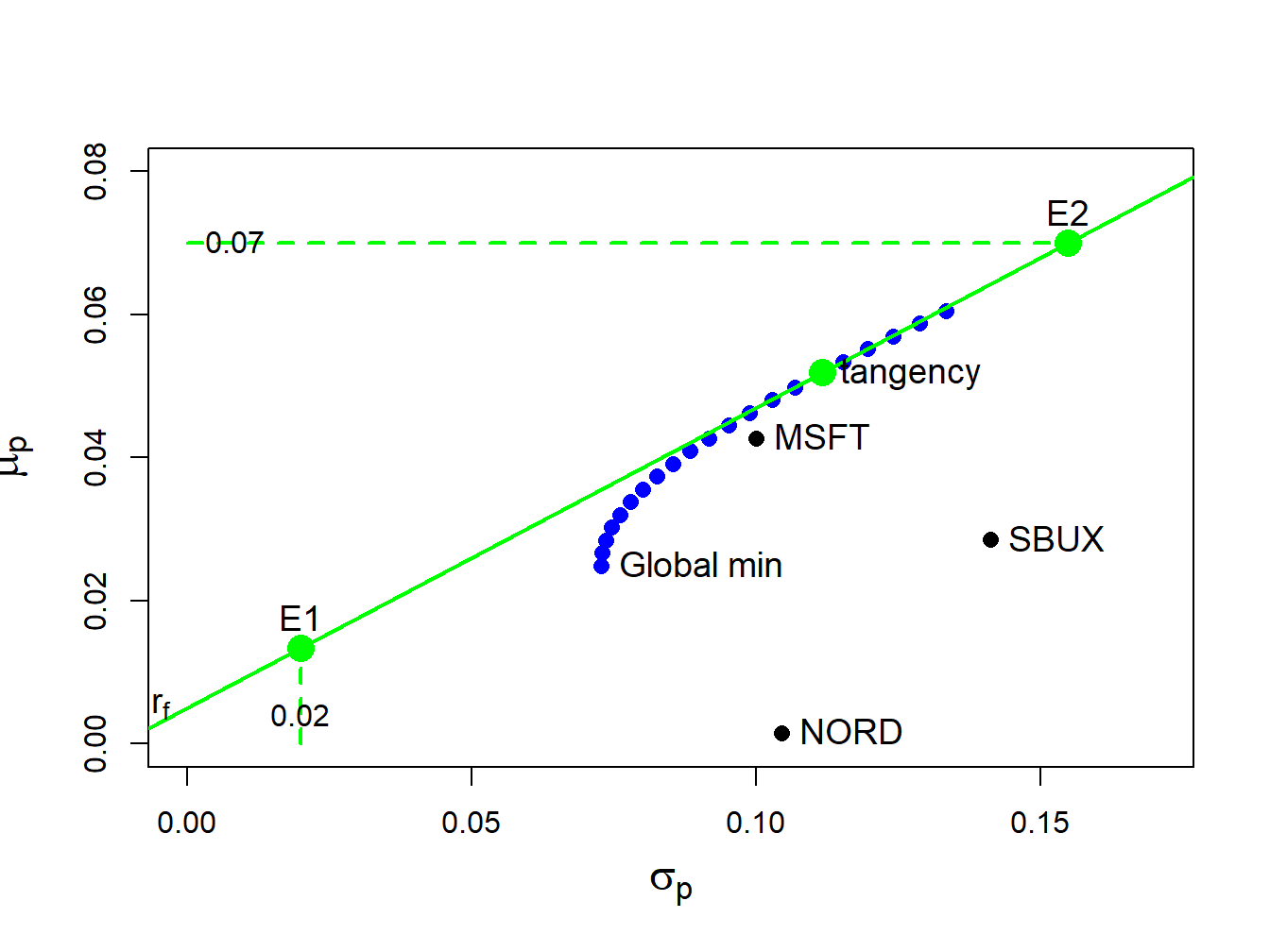

12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

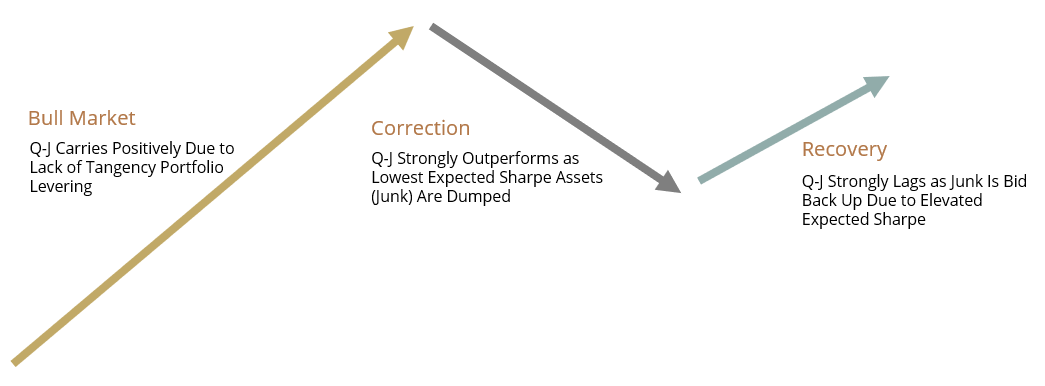

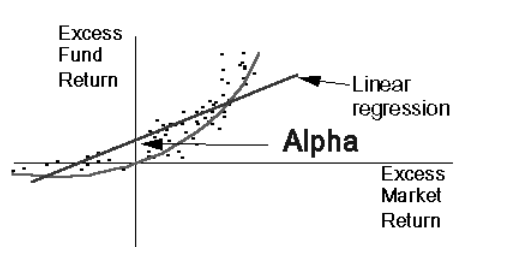

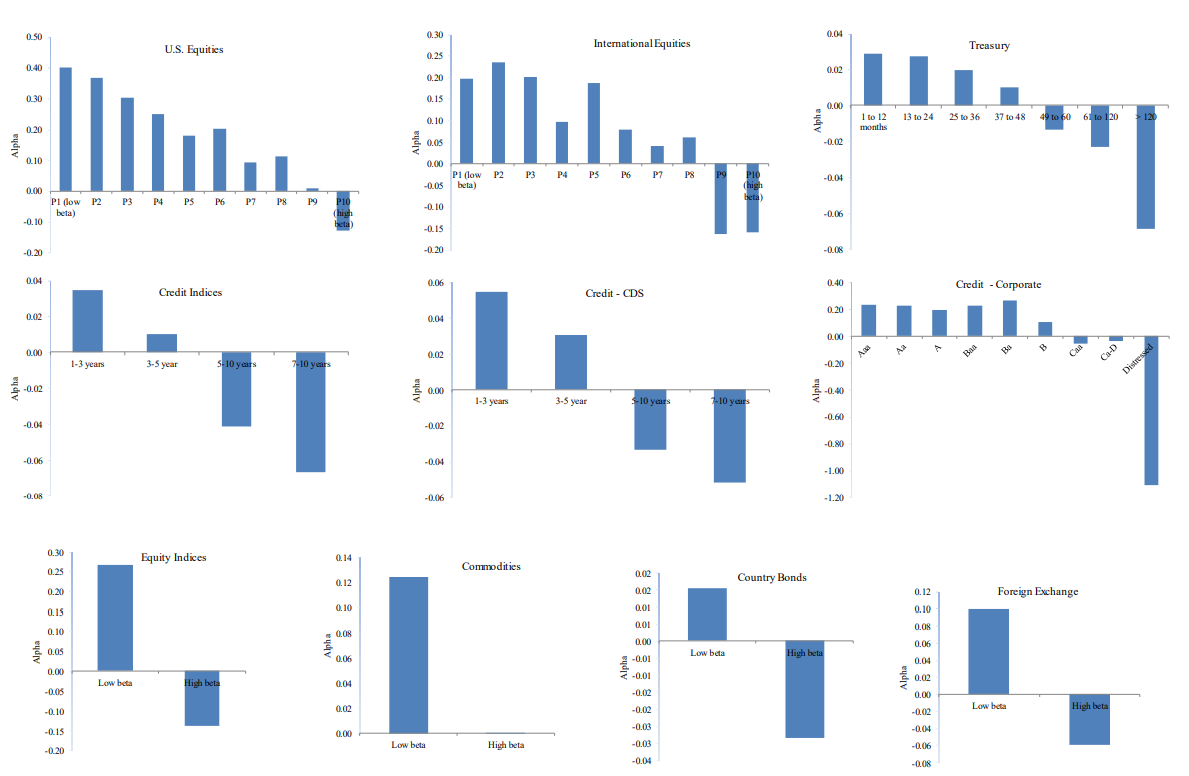

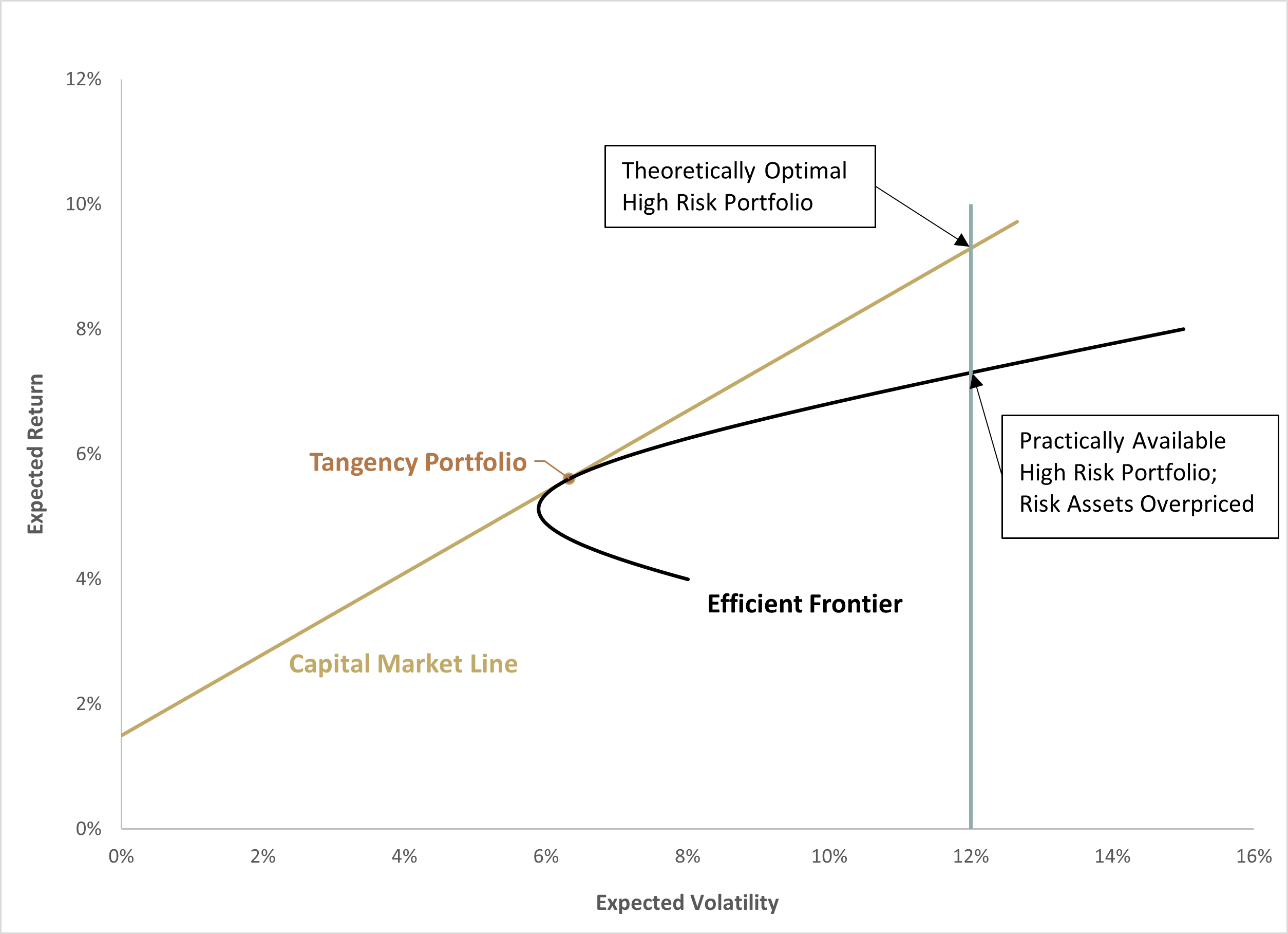

A Credit Hedge You Get Paid to Hold? Understanding Positive Return Expectations for Quality-Junk | Simplify

Quantifying Mutational Response to Track the Evolution of SARS-CoV-2 Spike Variants: Introducing a Statistical-Mechanics-Guided Machine Learning Method | The Journal of Physical Chemistry B

A Credit Hedge You Get Paid to Hold? Understanding Positive Return Expectations for Quality-Junk | Simplify

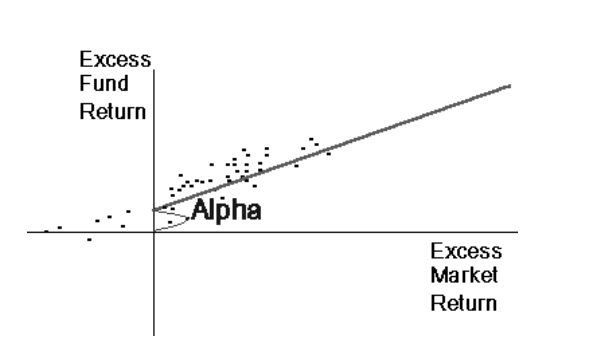

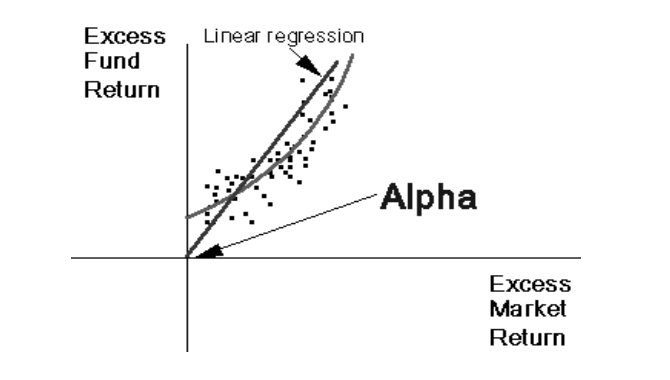

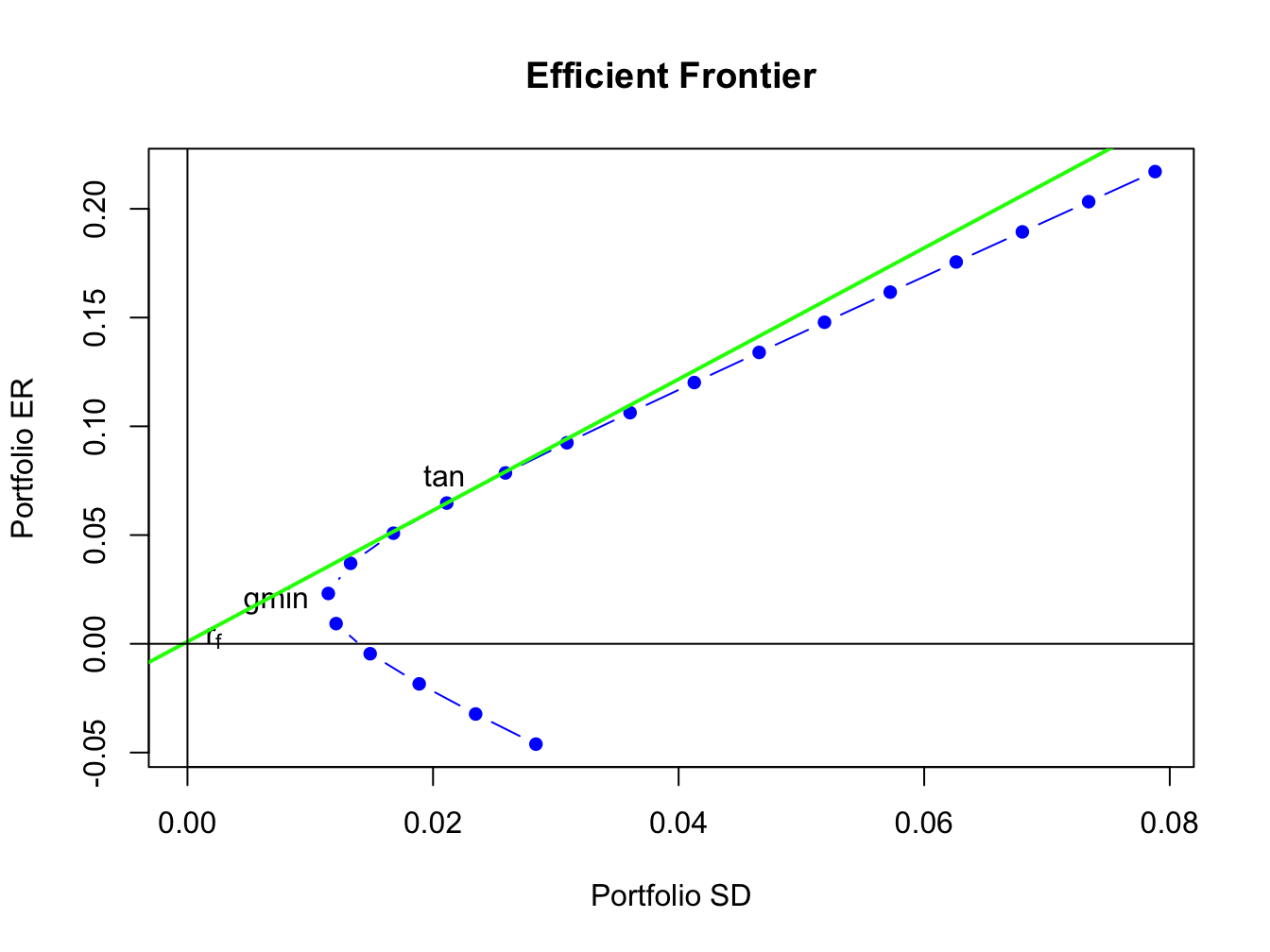

12 Portfolio Theory with Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

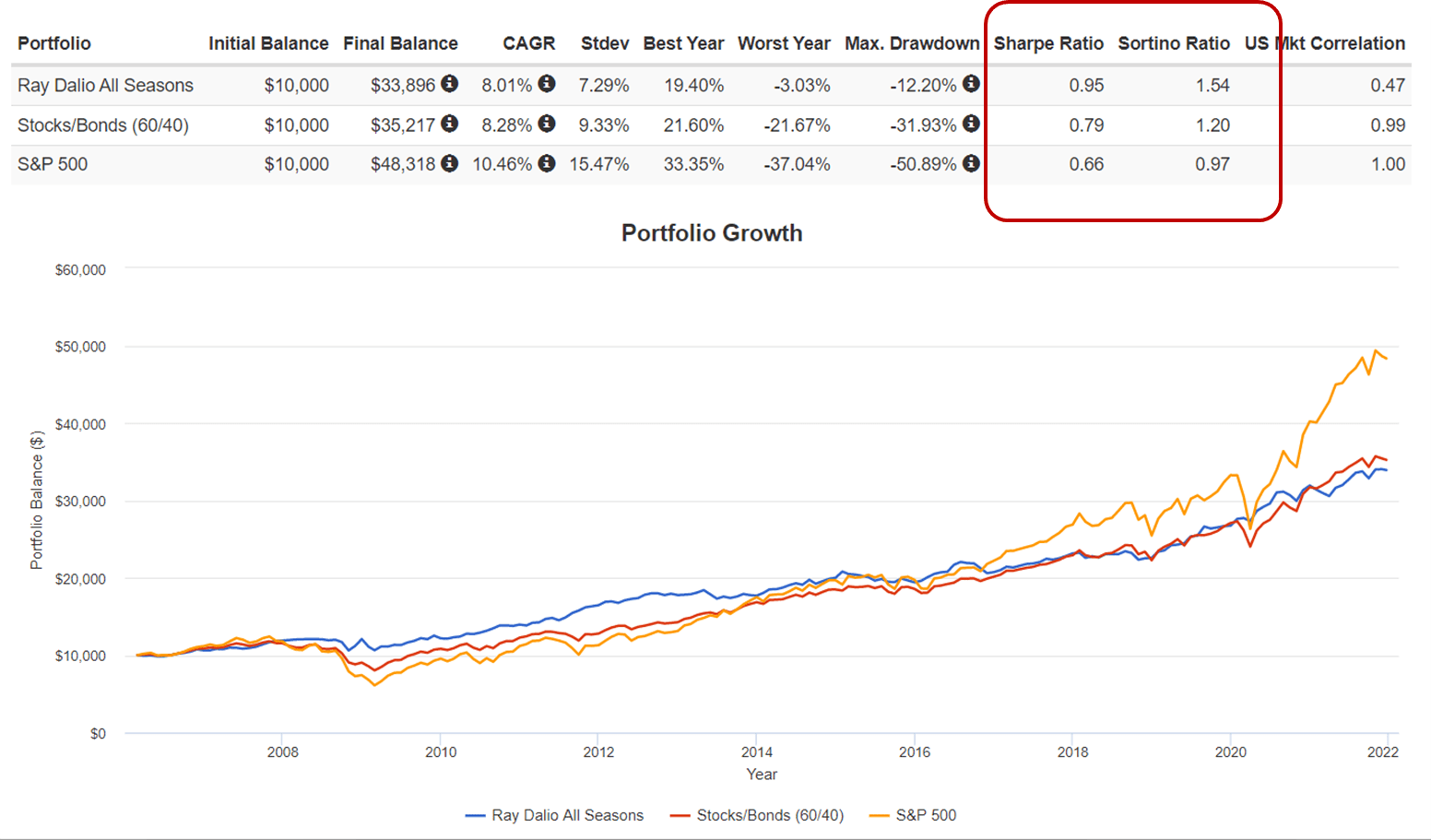

My Guide to Hedgefundie's Portfolio and Why I'm 100% Invested in it for FatFire and WhaleFire : r/financialindependence

Corey Hoffstein 🏴☠️ on Twitter: "Say what you want about “the environment,” this is a pretty impressive realized return. - Lever up stock/bond tangency portfolio - Allow up to 50% leverage -

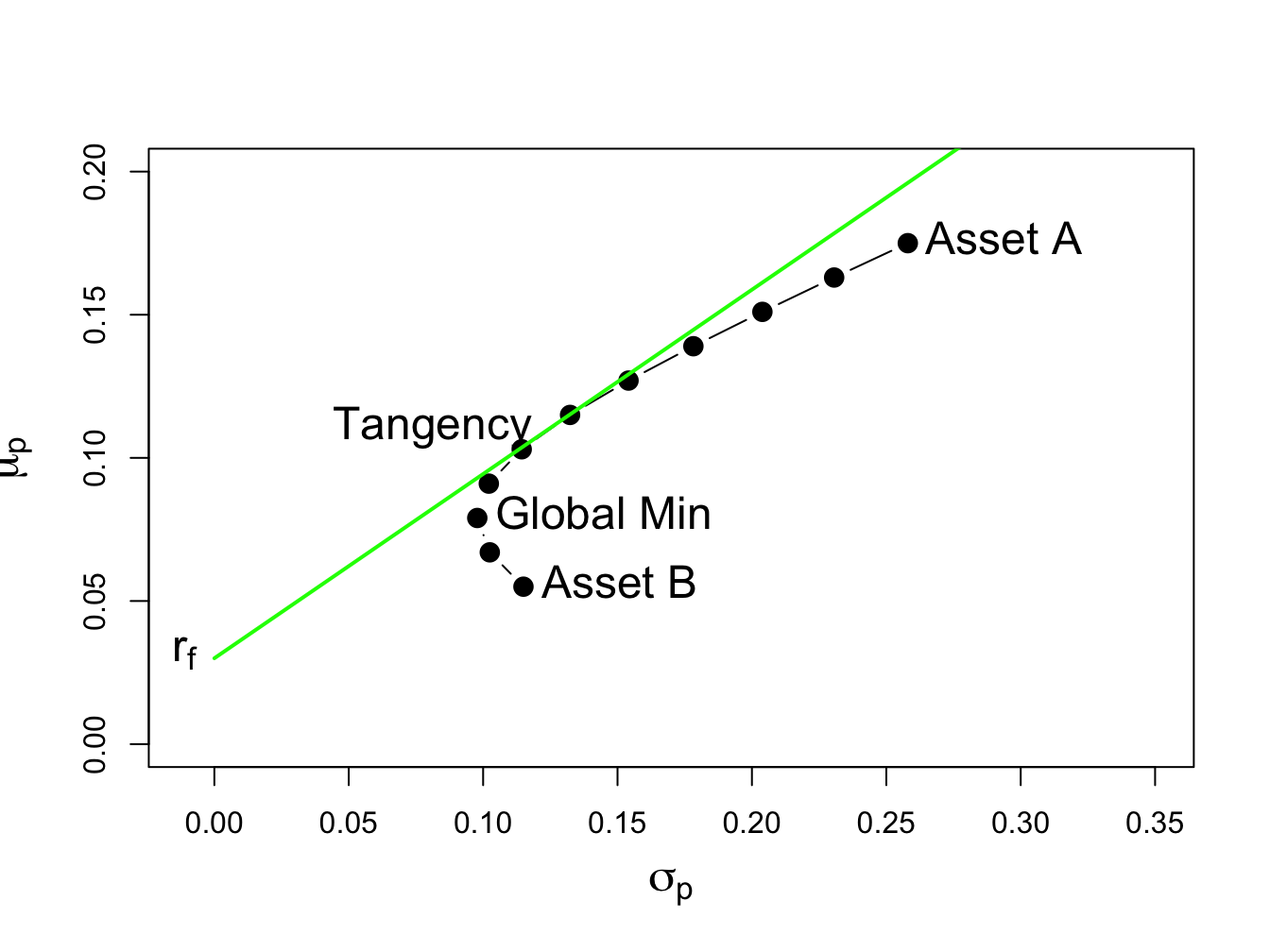

Tangency portfolio point, P, determined by tangent line from risk-free... | Download Scientific Diagram